Many people are looking for alternative forms of investment in 2018. With the stock market at all time highs and with the idea that a recession may be on the horizon many people are scared of losing their hard earned 401k or private investment accounts.

The sentiment surrounding the current market is admirable. However, bubbles always burst.

Many have claimed that the CryptoCurrency boom is also a giant bubble waiting to pop.

Are these the people that have dedicated a considerable quantity of time to learning about CryptoCurrency and the technology behind it?

Do those that are discounting blockchain technology and CryptoCurrency fully understand that there are options other than Bitcoin to be invested in?

Did you know that many large corporations have adopted Bitcoin and alternative CryptoCurrencies, commonly referred to as AltCoins, as a valid payment method?

There are many reasons that CryptoCurrency is one of the best investment opportunities of 2018 and there is a reason that CryptoCurrency has changed my life for the better.

It can change yours too. Just hear me out.

Are you tired of the big banks stealing from you?

You may not realize that banks are stealing from you every day that you have money in an account. It can be checking, savings, even CD’s and Money Market accounts.

Let’s talk numbers. Inflation in the US last year was 2.7% due to all sorts of environmental factors including the printing of more money.

The average savings account earns approximately 0.001% on the overall balance month to month.

Even the best CD’s for the short term (3-6 months) will allow you to only earn around 1.2% on your money.

So let’s say you invest all of your money in the highest yield account you can at 1.2% for 6 months. You would see a return of about 2.4% over the course of the year if you kept your cash invested over all of 2018.

Since 2.4% is less than 2.7% you are losing 0.3% on your money every single year in simple terms.

Still not convinced the banks are stealing your money? Keep reading.

In 2008 when Congress approved the $700 billion bailout for the banks after they issued countless subprime home loans and suddenly realized that borrowers were unable to pay them back, the banks stole from you even more blatantly than they do every single day.

Why is it that your government decided to bail these banks out, but not absolve your mortgage debt?

If you had a home loan in 2008 and didn’t foreclose or short sale, you may still be paying on a mortgage and actually be upside down in your home.

When the banks got bailed out, did they bail out those folks who couldn’t pay their mortgages? No… unfortunately they did not.

Now, let’s take the population of the United States in 2008. That number, according to the government census was 304.1 million people.

About 63% of that population were between the ages of 18 and 65. So likely they were not under their parents roof/working, or they were retired and eligible to draw Social Security.

If you were to issue a check to every United States citizen included in that 63%… about 191.5 million people would have gotten a check for $3,653.00.

That may not seem like a lot, but nobody can seem to recall the banks paying it forward and returning to you any interest or helping you with any payment programs.

That may not seem like a lot, but nobody can seem to recall the banks paying it forward and returning to you any interest or helping you with any payment programs.

They took people’s houses that couldn’t afford to keep paying, which sounds a lot like stealing to me.

So what if I told you that you no longer needed to deal with the Federal Reserve?

What if I told you that there was a finite limit of the amount of currency you could “print”?

What if Goldman Sachs, JP Morgan, Wells Fargo, US Bank, and all the others no longer had control over your life?

Would you be interested in giving that a shot?

If so, keep reading. If not, that’s understandable. Many prefer to stick to what they know and there is absolutely nothing wrong with that.

What is Bitcoin?

The Bitcoin blockchain was first created in 2009 by an unknown inventor who went under the alias of Satoshi Nakamoto. The true inventor has yet to come forward, or at least those who follow Bitcoin are unsure whether or not to believe if the real Satoshi has exposed their self.

There is a total of 21 million Bitcoin to be mined and the estimated date that all Bitcoin will be mined is due in the year 2140. It is impossible to predict the exact date and time due to the ever changing mining environment.

Essentially, Bitcoin is a form of digital currency that allows peer-to-peer or over the network transactions without the support of a middle-man or centralized bank. This is where the term decentralization is derived.

You may have seen Bitcoin denoted as $BTC many times on the internet or social media sites.

Modern encryption technology allows those using Bitcoin to perform transactions anonymously. There must be a network in place of “miners” that generate the tokens based on proof of work and approve transactions.

Without this network a transaction cannot be confirmed or completed. In addition, if this network does not recognize the transaction as a true or real transaction, it rejects the transfer completely preventing any sort of fraudulent activity.

Now that you get the idea behind Bitcoin, let’s talk about the technology behind it.

This is by far the most important part, because even if you don’t trust the idea of Bitcoin, you may trust the idea of blockchain technology.

What is Blockchain Technology?

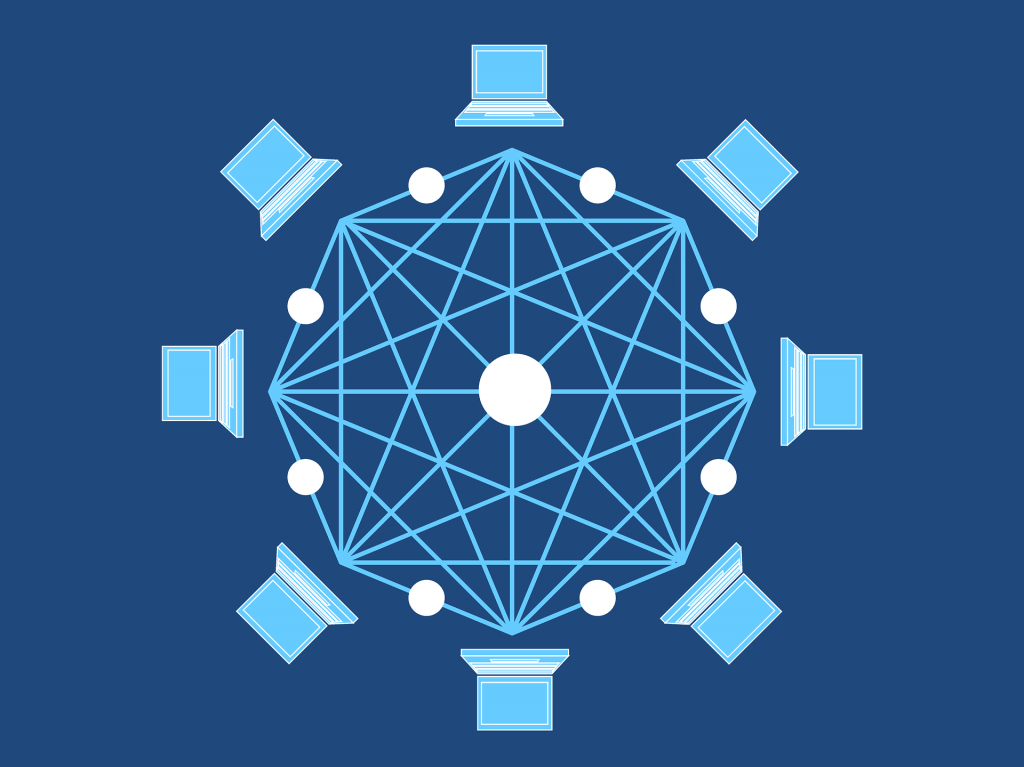

For simplicity, imagine you are keeping the books at a company. Any company.

Okay, now every time a transaction is made, you write it down with a very unique identifier or confirmation number. This book is continually populated and there is never a missed transaction.

Now imagine that the book is now controlled by a large number of individuals all writing continuously tracking every transaction. No central book exists, so someone from engineering cannot come in and alter this book without making it different from the other books.

Think about the fact that in order for a transaction to occur, it has to be validated across all of these books and confirmed. If someone were to alter one particular book, and now all the books did not match, the transaction being placed on the altered book would be deemed as fraudulent or untrue.

This seems a bit complicated, but really it is quite simple. If every computer that is supporting the blockchain network does not agree that this is the true chain, then the transaction will not be completed.

The benefit of blockchain is that there cannot be any single lapse in the chain. It would have to fail across the entire network.

Since this is a decentralized network and anonymously controlled by millions of processing units around the world, no one hacker can access the entire network and break the real blockchain.

If this sounds unbelievable, then why is it that almost 30 years after blockchain technology was created, has it yet to have been broken?

There is no more error, no more government printing more or extending a chain. Once the blockchain is set, it is run until it’s complete.

After that, the network supporting the blockchain exists simply to confirm transactions. Hopefully you now understand blockchain. So let’s move on beyond Bitcoin and the basics of blockchain technology and talk about it’s other applications.

Are there CryptoCurrencies other than those that CNBC and Yahoo Finance shove down everyone’s throats?

If you have any sort of financial knowledge you have probably seen articles from CNBC, Yahoo Finance, and other entities discussing what I am discussing here… CryptoCurrency.

Maybe you watch Bloomberg on the television and it has been a hot topic there as well. Do you think that these so-called industry experts and analysts really understand what it is they are talking about?

If you didn’t know already, there are other CryptoCurrencies aside from Bitcoin.

Here are just a few of the top market cap coins to date:

The folks on Wall St. and those pumping stocks on TV have figured this out.

Now they have their skin in the game and want to make their own money.

What do they do?

They promote a particular currency and discuss its purpose hoping to convince you to buy this currency, increase its value, and then they will sell making a huge profit.

Take for example Ripple, or $XRP. This is a relatively centralized bank based coin that CNBC has been on a hot streak of promoting lately. The value rose considerably as shown in the chart below once it became a “mainstream” coin.

However, what many don’t know is that there are far more coins out there than what the mainstream media is promoting. These AltCoins actually have much better technology behind them and the white papers are publicly available for review.

The point here is that just because a so-called expert pretends to know CryptoCurrency, they may not understand that the purpose behind CryptoCurrency and blockchain technology is not so that we can remain centralized within the banks using Ripple.

The purpose is all the wonderful day-to-day applications that different CryptoCurrencies support.

Currently, you can use CryptoCurrency debit cards to purchase items just like you would with a regular debit card anywhere that accepts Visa, MasterCard, etc.

Support for CryptoCurrency is only increasing with the ability to book hotels on Expedia, purchase goods on Overstock, buy Xbox Games, perform Real Estate sales or transactions, and even buy a McLaren from my good friends at McLaren Newport Beach.

I am Koenigsegg fan myself but I digress.

What coins should you invest in? Personally, I am invested across the board in the best technologies I can find. I have read countless white papers and have a few favorites in almost every category.

Some think they may have missed the CryptoCurrency boom, but that’s not true.

The current market cap of all coins is approximately $502.20 billion whereas the total current market cap of the stock market is $18.5 Trillion. If even 10% of that wealth shifts to CryptoCurrency you will see unfathomable gains.

I suggest you start your own research, read some white papers, and purchase some AltCoins based on what you feel is right. If you’re wondering where to do so? I have the answer for you.

Where can I purchase these AltCoins?

You have probably heard of the main Crypto platforms and exchanges like CoinBase or the background exchange owned by CoinBase called GDAX (sign in with your CoinBase account).

These platforms automatically generate you a wallet to store your cryptocurrency in and this will allow you to transfer currency to or from that platform.

For fiat ($USD, etc) purchases of Bitcoin, Ethereum, or Litecoin this would be an okay place to start investing.

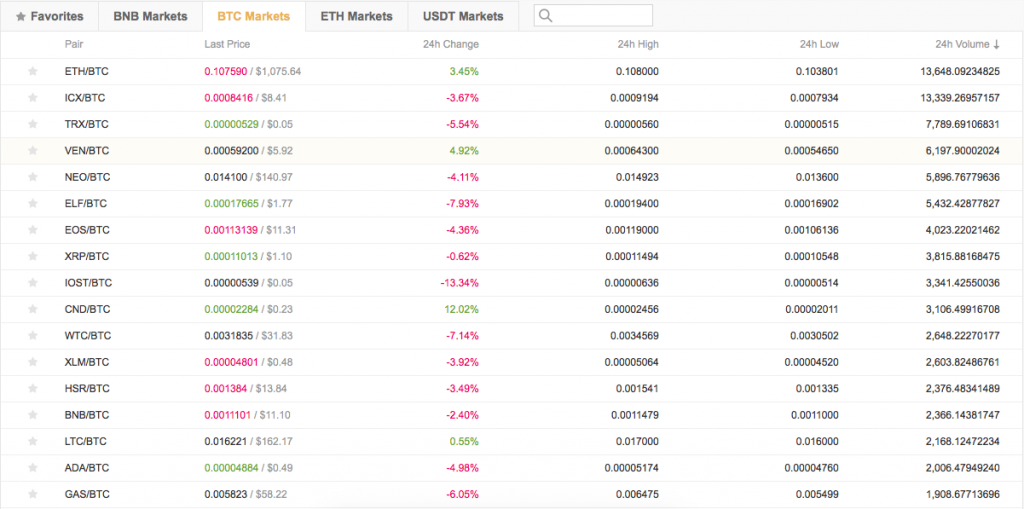

If you are looking to invest in AltCoins which is a much more lucrative investment for 2018 profit then I would recommend the exchange Binance. Binance has access to countless coins and these currencies have much smaller market caps or values.

Many of these coins have seen gains in the upwards of 1,000-2,000% in under a year. I’m not saying that you should go into investing all of your fiat currency into a coin called $DOGE or $DRGN… but there are many coins such as $ICX that would be a great place to start.

If you are interesting in investing in AltCoins sign up for Binance today by clicking here.

Binance is an asian run website, but it has always been secure for me and can be trusted. I have enabled multiple authentication methods that serve as added security for the site and prevent hackers from stealing funds.

Remember to follow the security protocol of every exchange and PROTECT YOUR ASSETS.

How CryptoCurrency changed my life and why CryptoCurrency is a top investment of 2018…

If you still need convincing that CryptoCurrency will be one of the top investments in 2018 then here’s where I tell my personal experience with CryptoCurrency.

I bought Bitcoin in 2016 when a friend explained to me Blockchain technology.

I wasn’t interested in the “digital gold”, I was interested in the technology behind it and what it could do for the global marketplace.

The idea that I can send currency to my friends in Germany, Russia, Spain, the UK, or anywhere else on the planet was exciting. Whether it be for a birthday present, some awesome imported German Beer, or just to pay them for helping me out with a homework problem this seemed like a great idea.

When I first started reading white papers on AltCoins (papers outlining the technologies behind the currency and the intended purpose) I realized that Bitcoin transaction fees and the speed of the transactions could be enhanced.

I immediately starting diversifying my investments into coins like $RDD, $XRP, $STRAT, etc.

This is when CryptoCurrency changed my life. Within three months I had doubled my initial investment. I then dedicated my next two paychecks to CryptoCurrency as the technology began to catch steam.

Not only was I gaining in quantity of $BTC (Bitcoin) because of the increase in value of my investments, I was making $USD like mad.

I stopped caring about $USD almost completely and made it my mission to gain as much $BTC as possible.

To date I have made 5,000% on my initial portfolio investment and I own 14 different types of CryptoCurrency assets. Many people have haggled me to cash out for fiat, but I believe in the future and I believe in Crypto.

Don’t misunderstand me, I’m not an idiot. I paid off my student loans, I paid off my home, and I paid off all my consumer credit debt and my vehicle. Now, I’m waiting for the day that CryptoCurrency is the only currency.

Humor me, think about how often you use cash for a second.

If you find yourself using a card for every day to day transaction, you are already using digital currency. However, the technology is weak, outdated, and easy to hack.

If you don’t believe that this will be the norm one day. That’s perfectly fine. If you don’t believe the current value of $BTC is what it should be, that’s also fine.

If you want to know more or talk further about CryptoCurrency in general. Drop me a comment below and I’d be happy to talk it over and respond personally to your questions and comments.

Share with your friends on Social Media and leave a comment below with your new $RDD wallet address and I will send you 1 $RDD as a thank you.

Disclaimer: The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

I have been wondering about crypto currency recently. You have really opened my eyes to this. Thanks.

Hey Rick,

Glad this article could help you out.

Thanks for reading!