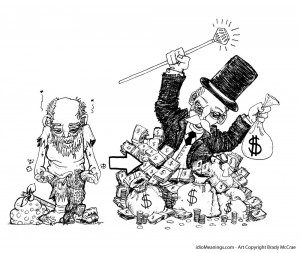

A lot of people that visit Incite Wealth are looking for a way to escape their day job. A lot of times these people are broke. That word shouldn’t scare you or hurt your feelings, I’ve been broke myself.

A lot of people that visit Incite Wealth are looking for a way to escape their day job. A lot of times these people are broke. That word shouldn’t scare you or hurt your feelings, I’ve been broke myself.

There was a point in time in college where I was buying bags of frozen chicken and 11-12 lb bags of rice because it was the cheapest thing I could eat.

This was an important time in my life, because learning how to sustain myself when I was broke has allowed me to be a smarter spender now that I have attained a bit of financial freedom.

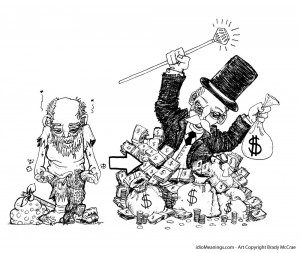

Let’s talk about some of the pitfalls that keep your every day person from becoming a millionaire…

Over Spending

This is probably the biggest problem I see with your average person. This is especially a problem for those that are broke. Those broke people will never be rich.

This is probably the biggest problem I see with your average person. This is especially a problem for those that are broke. Those broke people will never be rich.

Spending more than you earn, or spending more than necessary is something that many people have been brainwashed to believe is okay.

I’m here to tell you that this is not the case. Over spending will singlehandedly keep you from becoming a millionaire and I will guarantee that.

How many people do you know that are buried in debt?

It doesn’t matter what kind of debt, it can be credit card debt (the most common), over extended auto loans, or tons of student loans.

No matter the type of debt, it restricts people from obtaining their financial goals. The modern mentality promotes this lifestyle. There is a perpetual belief that leveraging your credit is the only way to have the things you want. False. Pay cash like I do. (P.S. It feels good to walk into a dealership and drop cash on a desk.)

Do not over spend. Eventually any money that you DO earn will have to contribute to repaying your debts and you will never get ahead. You will never be able to invest in real estate, or invest in your online business, or become a successful entrepreneur.

Lifestyle Inflation

So maybe you have achieved some success in your life already. Maybe you are here just to increase this success.

So maybe you have achieved some success in your life already. Maybe you are here just to increase this success.

However, are you allowing your lifestyle to be inflated because you make a few more bucks? If you are spending more because you make more, you are contributing to your own financial failure and you don’t even realize it.

I understand the desires for a Luxury Lifestyle. I too live a little bit of a luxury lifestyle, but I have worked my way up to that by living below my means for as long as I can remember.

If you don’t know what I mean when I talk about lifestyle inflation… let me explain:

Say you currently drive a 2010 Toyota Corolla, and it gets you from point A to B, it’s reliable, low maintenance, has low enough mileage, and it’s paid off.

Now, you get a raise at your day job…Say this adds an extra 5k a year to your income (maybe that’s a bit high but you get it). Now you take that extra 5k a year, run out and buy a brand new BMW.

You have now taken on a car payment, violating rule number one and putting yourself in unnecessary debt. You have also just committed direct lifestyle inflation (yes this is a crime while you are building your empire).

The BMW is the exact same thing as your Corolla, it’s reliable, low maintenance, has low mileage…but it is NOT paid off.

That 5k a year could be contributing to an investment of some sort. If you were to put it towards your entrepreneurial endeavors this could turn into more money! People often blow their tax return in the same fashion…See my article on what to do with your tax returns to learn about proper investment opportunities.

Many people don’t realize that they are holding themselves back financially by inflating their lifestyle. They begin to buy flashier things because they value instant gratification over the long term benefits.

The truth is… you can leave below your means… you were likely broke at one point, and living like your broke when you aren’t is the key!

Avoiding These Pitfalls

I know some of these habits are easy to fall into so I have a couple options for you to remain consistent with your spending. This will benefit you when you do become rich, so start now…

I know some of these habits are easy to fall into so I have a couple options for you to remain consistent with your spending. This will benefit you when you do become rich, so start now…

- Create a solid budget and stick to it. You likely have a budget when you’re broke because you have no choice. Good. Create a broke person budget, and hold true to this broke person budget until you are no longer broke.

- Use my 5-10% Rule. The 5-10% Rule essentially means that you whatever increase you see in salary or general/passive income, you only increase your spending by 5-10% of that increase. Therefore, if your income increases by $1,000 a year, you only spend $50-$100 more per year.

- Remind yourself of the necessities. I personally have a list of necessities pinned to my bulletin board in my bedroom. This list is of the things that I ACTUALLY NEED. Create your own list (be honest) and I think you will be surprised at how few things you need to sustain yourself.

- Pursue your dreams. I lied when I said I don’t increase my spending significantly. Sometimes I increase my spending by the entire amount of my income increase. This spending, however, is directly reinvested in my business endeavors. Usually this income increase comes from these businesses, so an appropriate use of these funds is scaling up.

What’s left?

Get Rich…

This will not happen overnight. If you are conscious of your spending however, and you learn how to spend like a broke person than your path to riches will be much shorter and less stressful.

I personally had a lot of outstanding debt because I have made these mistakes myself. Guess what I had to do with all of my online revenue? Payoff my debt.

Now that I live debt free I spend like I am still eating chicken and rice every day, and the rest is invested in business. This is why I’m successful, and this is why it will be easy for you to be a success as well.

Remember:

Rich people stay rich because they keep their money or use it to make more.

Rich people stay rich because they keep their money or use it to make more.

If you have experience with overspending or lifestyle inflation, I want to hear YOUR story. Have you corrected this? If so, how did you do it and how do you feel now? Share in the comments below!

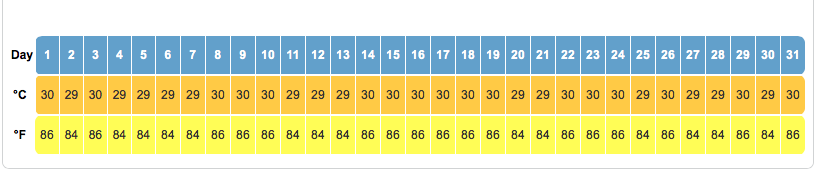

Usually Florida is known for it’s summer storms. Quite often when visiting in the summer months of June, July, and August you will not have a single afternoon outside to relax and soak up the sun.

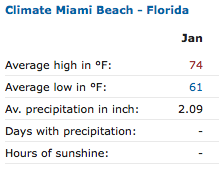

Usually Florida is known for it’s summer storms. Quite often when visiting in the summer months of June, July, and August you will not have a single afternoon outside to relax and soak up the sun. The cost of staying in Miami Beach per night can range from around $175-$500 depending on the exact location of the resort and the amenities you require from the hotel.

The cost of staying in Miami Beach per night can range from around $175-$500 depending on the exact location of the resort and the amenities you require from the hotel. Rent a Boat or Jet Skis. The very first thing you should do in Miami is get in the water. Everyone in South Florida loves their boats. You may as well experience this place like a local. So grab yourself a boat from one of the many boat rental companies in Miami Beach and get out on the ocean.

Rent a Boat or Jet Skis. The very first thing you should do in Miami is get in the water. Everyone in South Florida loves their boats. You may as well experience this place like a local. So grab yourself a boat from one of the many boat rental companies in Miami Beach and get out on the ocean. Hit a Club or a Beach Bar. Whether you are a big drinker or not, you should at least check one of these places out. Miami Beach is home to some of the best nightlife. This especially holds true during the summer, but January is no slouch. Since the temperatures in January only see the lower end of the 60s many people are still out at night exploring this city.

Hit a Club or a Beach Bar. Whether you are a big drinker or not, you should at least check one of these places out. Miami Beach is home to some of the best nightlife. This especially holds true during the summer, but January is no slouch. Since the temperatures in January only see the lower end of the 60s many people are still out at night exploring this city. A lot of people that visit Incite Wealth are looking for a way to escape their day job. A lot of times these people are broke. That word shouldn’t scare you or hurt your feelings, I’ve been broke myself.

A lot of people that visit Incite Wealth are looking for a way to escape their day job. A lot of times these people are broke. That word shouldn’t scare you or hurt your feelings, I’ve been broke myself. This is probably the biggest problem I see with your average person. This is especially a problem for those that are broke. Those broke people will never be rich.

This is probably the biggest problem I see with your average person. This is especially a problem for those that are broke. Those broke people will never be rich. So maybe you have achieved some success in your life already. Maybe you are here just to increase this success.

So maybe you have achieved some success in your life already. Maybe you are here just to increase this success. I know some of these habits are easy to fall into so I have a couple options for you to remain consistent with your spending. This will benefit you when you do become rich, so start now…

I know some of these habits are easy to fall into so I have a couple options for you to remain consistent with your spending. This will benefit you when you do become rich, so start now… Rich people stay rich because they keep their money or use it to make more.

Rich people stay rich because they keep their money or use it to make more.

Depending on the occasion, you may all be heading to Vegas for many different reasons. I’ll list a few of the main reasons below:

Depending on the occasion, you may all be heading to Vegas for many different reasons. I’ll list a few of the main reasons below: The Architecture/Rides: I know I probably shouldn’t lump these into one category, but most of the people that are in Vegas for one of these reasons is really drawn to the other attraction. This is essentially the category all your typical tourists fall into or people who have never visited Sin City before.

The Architecture/Rides: I know I probably shouldn’t lump these into one category, but most of the people that are in Vegas for one of these reasons is really drawn to the other attraction. This is essentially the category all your typical tourists fall into or people who have never visited Sin City before. Everyone thinks that there is some magic formula to gambling.

Everyone thinks that there is some magic formula to gambling. Don’t Drink Too Much: If you start to drink too much, you will most certainly lose your money quickly. Your inhibitions go out the window when you drink so you are more likely to bet big and pretend like you’re going to win it. This is usually not the case (the odds are against you remember). Free drinks will come at you all night, make sure to work in some water. Check out

Don’t Drink Too Much: If you start to drink too much, you will most certainly lose your money quickly. Your inhibitions go out the window when you drink so you are more likely to bet big and pretend like you’re going to win it. This is usually not the case (the odds are against you remember). Free drinks will come at you all night, make sure to work in some water. Check out  I define winning as gaining the most you can out of the experience. I enjoy gambling, but I consider it an expense for the brief getaway.

I define winning as gaining the most you can out of the experience. I enjoy gambling, but I consider it an expense for the brief getaway. Join a rewards program! There are a couple major programs in Vegas including

Join a rewards program! There are a couple major programs in Vegas including  In addition you can sign up for the

In addition you can sign up for the