Exchange Traded Funds:

The second most important investment of 2018 behind Real Estate, Exchange Traded Funds can provide great upside and potential growth for your money.

Many people aren’t even sure what exchange traded funds (ETFs) are in the first place. Well allow me to put it in the simplest form that I can think up:

ETFs are essentially funds, much like stocks, that can be traded on the major exchanges. This includes the New York Stock Exchange (NYSE).

There are other exchanges such as the OTCBB for smaller companies that have issued initial public offerings (IPOs) of shares but we will stay away from those for now as they are generally deemed Penny Stocks and not meant for year long investment.

An ETF holds different assets. These assets can be in the form of commodities like gold or silver, or maybe a variety of stocks and bonds, or both.

ETFs allow you the ability to invest in many different types of assets at once and generally track the market based on the value of the assets that they hold.

So you may be asking why ETFs would make the list of the best investments of 2018. Well, that’s easy.

ETFs increase and decrease in value when the overall market indices do the same. When we are in a bull market, or a market that is generally rising in simpler terms, it is easy to generate passive revenue from ETFs.

If the overall market, or more specifically the market surrounding an ETFs holdings is increasing, then your investment also increases accordingly.

So why wouldn’t you just invest in individual stocks and hope for the big gains?

ETFs are easier than picking individual stocks because they automatically diversify your portfolio and allow you to start investing for less up front cost.

When you pick individual stocks you may have to invest $150 a share or more.

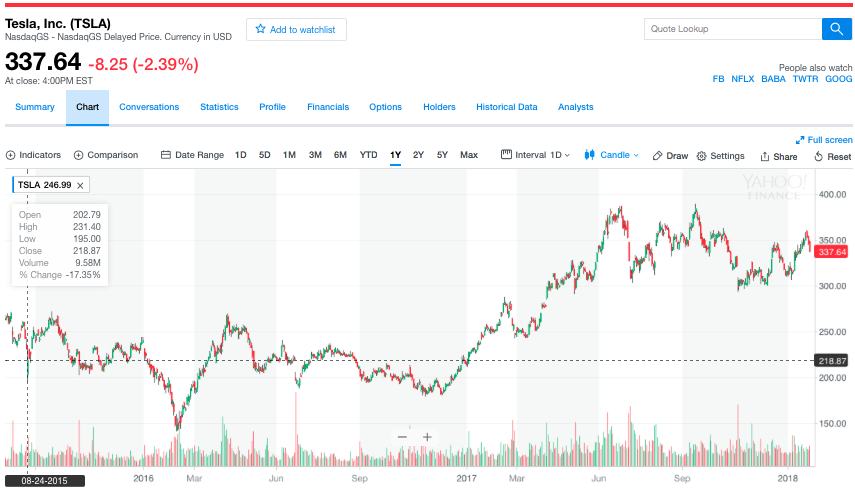

For example, take Tesla…a company growing in popularity over recent years that swings pretty heavily in stock price and has seen solid gains overall.

If you were to invest in Tesla at the time this article was written you would have to come up with around $340/share.

This is a lot of money when you first begin to allocate portions of your wealth to the market. In addition, you are limited to purchasing whole shares of Tesla’s stock which means if you have less than $680 you are unable to buy 2 shares of Tesla stock.

ETFs allow discounted prices for investors, but still allow you to hold some sort of stake in popular stocks.

Say an ETF has holdings in Tesla and Tesla does well overall. You see gains in your portfolio proportionate to the exposure that ETF has to that particular stock.

Quite often, you can purchase stake in an ETF for a much less up front investment than buying particular stocks directly.

Many ETFs trade below $100 so you can accumulate a much larger quantity of holdings in that ETF. In addition, the money you make on your investment can grow at a more rapid rate than it would if you were only able to buy a singular share of individual stock.

This is especially the case if that stock underperforms its associated sector and the ETF you have invested in tracks the overall sector.

Most people believe that they can beat the overall market through day trading, but generally speaking, that is not true. Up to 93% of those who call themselves “day-traders” fail to exceed the gains of the S&P 500 year over year.

Simply put, if you were to invest in just the S&P 500 you would have seen around a 10% gain year over year over the past 2o years. Financial advisors, traders, and investment bankers actually only see up to around 5-6% gains per year on average.

Get started investing in ETFs and generating returns on your investments today. Sign up for RobinHood today and invest with zero trading fees!

If you still have questions about ETFs ask them in the comments below and I will do my best to answer!

Disclaimer: The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

Thank you for explaining what an ETF is. I think I probably know enough to be dangerous, so I am trying to gain a better understanding of the markets as a whole. My question is, how are these different than a mutual fund? Also, crypto or cyber currency is all the rage right now, is this something you can do with an ETF? You have some great information on your site, I will definitely bookmark this and check back soon.

Hi Steve,

Thanks for reading! My favorite article I’ve found that really explains the difference is from Investopedia. Check it out here: https://www.investopedia.com/articles/exchangetradedfunds/08/etf-mutual-fund-difference.asp

Generally speaking, the tax implications are different and ETFs are usually lower cost options for beginning investors so they are my preference.

My next article is actually on Cryptocurrency. I invest pretty heavily in AltCoins and that is actually how I generate a pretty significant income on the side. I’ll link it in the comment thread here when I finish writing it and you can read up on what I have to say!

There are a lot of firms working to create ETFs for Crypto but it’s been slow going with the SEC and current regulations. Everyone is still trying to figure out what the move is. I’ll keep you updated as I learn more!

Thanks again for reading,

Dalton

I love EFTs simply because of their diversity. Lots of people are unaware of them and are also afraid to invest. Gaining 10% interest on average is such a good deal if you think about it. It is not hard to do either.

Investing in the S&P is one way to do it. I definitely would not day trade because that is a very volatile way of earning. Thanks for the education today.

Hi Nate!

Thanks for writing. Sorry for the delayed response it’s been busy over here on my end. 10% can be a lot of money with a solid initial investment. As your overall portfolio value increases that 10% will be more money year over year as well. So essentially it is compound earnings.

Day trading can be profitable but if you are looking for steady gains overall ETFs are my go-to. That or Real Estate are the top two in my opinion.

Thanks again for reading and enjoy your day.

-Dalton