There have been so many insane statements made about taxes and the rich over the last couple of years. In fact, a lot of attention has been allocated towards the wealthy and how they “game the system”.

Many people have heard stories about Donald Trump not paying any taxes at all and demanded he share his tax returns with the world. Some of those same people are pushing to tax anyone who makes over $10 million yearly at a 70% income tax rate.

This isn’t a political support statement or an opinion on whether or not Trump should share his tax returns, it’s just a fact. With this fact comes controversy, and we love controversial topics here at Incite Wealth.

So…it’s time we addressed everyone’s lingering question, “do rich people pay more taxes than your average Joe”?

To clarify, the rich blatantly pay out more in taxes on a dollar for dollar basis. For example, if a wealthy individual has $1 million in income for the year, and their effective tax rate is 25%, they pay out $250,000 in taxes that year. If a normal, every day salaried employee makes $100,000 in a year with the same tax rate they will only pay $25,000.

This concept is relatively straightforward.

More often than not, the wealthy, if also a salaried employee, would be in a much higher tax bracket at this income level. However, wealthy people are intelligent. Wealthy people also understand their finances and have taken the time to either hire someone who knows tax law or learn it their self. When you are educated on taxes you are typically able to make smarter decisions throughout the course of the year that can actually REDUCE your effective tax rate. The bottom line is, wealthy people pay less taxes from a percentage standpoint than the average salaried employee.

Understanding Effective Tax Rates

Simply put, an individual’s effective tax rate is the total amount of income taxes owed to the IRS divided by their total taxable income.

Corporations or companies are taxed different than an individual. The entity’s effective tax rate is the total tax expense divided by annual taxable revenue.

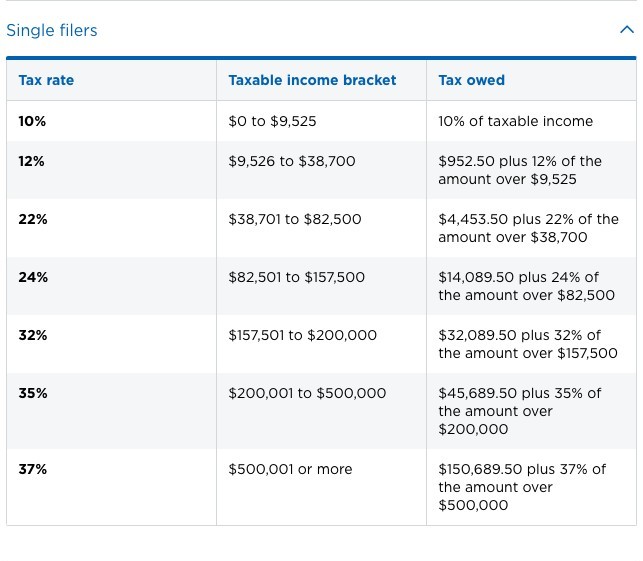

Both individuals’ and corporations’ tax rates (marginal tax rates) are based on tax tables. Tax tables are based on either your total taxable income or your total taxable revenue. If you or a corporation bring in more income or revenue and end up falling towards the high end of a particular tax bracket, you will be responsible for paying more taxes and it’s likely you will have a higher effective tax rate.

For a single filing individual a tax table would look something like this:

An individual’s taxable income can be adjusted based on extraneous factors like 401(k) contributions, Healthcare Spending Account (HSA) contributions, etc.

An individual’s taxable income can be adjusted based on extraneous factors like 401(k) contributions, Healthcare Spending Account (HSA) contributions, etc.

A corporations taxable revenue can be adjusted based on other factors like employee salaries, charitable contributions, certain types of operating expenses (especially for rental property), etc.

How the government divides up what you or a corporation owe annually is pretty complicated and convoluted. Since that is not the point of this article we will save that discussion for another day. For now, let’s talk about the difference between average individuals and wealthy individuals.

Why Wealthy People Have a Lower Effective Tax Rate

The wealthiest people in the United States (and some other countries) utilize legal tax loopholes that allow them to reduce their adjusted gross income significantly.

Most of the wealthy own businesses or corporations. Each coming with their own set of deductions. An individual is likely to earn a salary, bring home income, and thus be taxed on that income before they see their paycheck. This means that individual brings home only a fraction of what they actually made.

Businesses are taxed the other way around. Essentially a business is taxed after revenue is earned and potentially redistributed. If a business reinvests their revenue into their bottom line and they have significant operating expenses the business is then taxed on less revenue.

A key concept written in Rich Dad Poor Dad, one of my top recommended business books, is that employees are taxed before they see their money. Corporations and business are taxed after they have earned and utilized the revenue to create more profit.

Depending on your individual income, you may be able to even take pass through losses from your business or utilize the lower corporate tax rates if you didn’t end up with a profit that year.

Take real estate for example. If your rental income from a property is $1,000 per month but between your property management fees, HOA, and mortgage interest you are showing a net loss for the year you can deduct that loss from your adjusted gross income reducing your marginal and ultimately effective tax rate.

These are the types of loopholes the wealthy take advantage of. We should note, however, that the idea is not to take a loss but to take advantage of the many deductions that real estate and other business ventures offer. Also, if your day job means you bring in a significant salary there are thresholds to be aware of for taking pass through losses.

You may be realizing that there is a pattern here. You may also be realizing that there is a significant benefit in working for yourself.

How To Take Advantage Of Tax Loopholes Like Wealthy Individuals

Invest in real estate:

Real estate investing is one of my absolute favorite business ventures to enter into. It is easy to get started, scalable, and there is an abundance of success and failure stories out there to help you stay the course, make the proper moves, and navigate the real estate market.

You can use one property as a basis, build reserves, and roll those profits into another asset. The best part is the plethora of tax deductions that owning property comes with. You can write off items like mortgage interest which can be HUGE for many properties in the California market.

The key factor here is that many expenses that you might accrue throughout the year pursuing real estate investments can offset income drastically reducing your effective tax rate and allowing you to take advantage of the same very legal loopholes that the rich already do.

If real estate might consume too much of your time and the idea of a brick and mortar style business managing renters, rentals, and property management companies seems overwhelming there are other options out there.

Become an affiliate marketer online:

This may be the best way to break into the entrepreneur space without much prior knowledge of business in general and more specifically online business. Starting your very own online business and become an online entrepreneur requires zero up front capital.

Affiliate marketing is a very unique space. Read more about affiliate marketing by clicking here.

Once you learn the steps required to become an affiliate marketer you will be well on your way to building your own business.

However, do the same tax benefits come with owning your own online business? The short answer is yes. The deductions may not be as big as real estate deductions, but you can write off home office, laptop, internet, etc. These deductions and expenses help reduce your bottomline. Ultimately, when your income explodes from affiliate marketing and you start earning thousands per month writing on your niche website you’ll realize very quickly those tax deductions are critical.

The bottom line is, paying more in taxes from a dollar amount perspective just means that you made more money that year. There is absolutely no problem with making more. However, you do need to pay attention to how much of it you are turning over to the IRS and you want to make sure you are taking full advantage of deductions that might lower your effective tax rate.

If you want to become an affiliate marketer, you can employ Wealthy Affiliate’s detailed training program for free. If you want to read my comprehensive review on Wealthy Affiliate as an affiliate marketing platform click the Getting Started button on the top of the page or CLICK HERE.

Please note: I am not a tax advisor or CPA. Any discussion above is simply personal experience on these subjects and in no way should be taken as hard financial advice. Thanks for reading and let me know if you have any questions in the comments section below.

Rich people should pay more taxes but the difference is that they pay their taxes after they have the opportunity to grow their income even more, whereas most people have their tax taken off their salary.

That, in turn, leaves the rich getting richer and vice versa.

But on another note, we all have the potential to create our own futures and wealth. Working for yourself as an affiliate marketer is one such way as you have pointed out. So it’s actually up to each of us to work hard for what we want in life.

Hi Michel,

I’m happy that you felt inclined to offer your opinion on this subject. This is precisely what they do. They bring in “business revenue” and that ultimately results in being taxed after they have reinvested and grown this capital even further. This is precisely how the wealthy keep and grow their money. It’s really a no brainer.

I believe the struggle is that most don’t realize they can also take advantage of the same tax laws that allow them to deduct a large sum of expenses.

I agree that becoming an affiliate marketer is perhaps the simplest way to gain many of the same deductions that you might get for running a larger corporation. Online entrepreneurship is very unique in that it allows you to break into a new space with little to no up front capital.

-Dalton

The subject of tax and returns us always a sentimental one. I believe rich people ought to pay more taxes because they earn a lot more than average people. It’s also smart how rich people take advantage of loopholes in tax laws to pay less tax. But, I think they’ll still pay out a lot of this money to their lawyers. For the benefits of average jocks like myself, isn’t it possible for us to also “beat” the system

Quite often a controversial one as well Louis!

I would say it’s quite simple to use the system to your advantage. As I mentioned in the article above, Real Estate and Online Entrepreneurship are two simple spaces that I’ve put a large quantity of my capital investment into in order to grow my income and ultimately have a plethora of deductions that I can utilize to legally reduce my overall AGI. It’s simple math. While I may be paying out more than I am making in Real Estate (with mortgage interest and depreciation), I am still building equity every time a rental check comes in on a property. I am also able to still build reserves and plan for vacancies which is important.

On top of that, my affiliate marketing business means that since the primary use of my internet, office, etc. are dedicated to running this business I can write some if not all of these expenses off come tax time. That helps offset some of the profits I’ve seen from becoming an affiliate of multiple programs like Wealthy Affiliate.

Hope those items above make sense! Let me know if you have any questions about getting started.

Thanks for reading,

Dalton

Awesome article. I enjoyed reading it thoroughly. You have wonderfully presented your real life experiences and learning. Robert Kiyosaki is always more concerned about Rich and Taxes and of course, it is required to listen to him and his advisors to manage our money and taxes.

In my country the tax amount is 30%, see, a new entrepreneur who just started off with his passion has to pay 30% as taxes. You’ve mentioned some tips to aback l avoid tax, such as real estate and affiliate marketing. My question is of you’re earning high amount in affiliate marketing, don’t you have to pay taxes! How Affiliate Marketing avoid taxes?

Thanks for sharing this informative article. It was useful to me.

Cheers

Akshay

Hi Akshay,

I am unsure of your laws in your country. However, in the USA you can write off expenses for your business. I do pay taxes on income from my affiliate marketing business. This is a good thing because it means I am profitable.

However, there is a caveat here. There are expenses associated with running an online business. My web hosting fees, internet, office, computer maintenance, certain softwares, PPC advertising expenses are all valid expenses that are being paid out to further grow my business and scale my affiliate marketing commissions.

If I write off these expenses it reduces what is “income or revenue” because I can then take income-expenses. Since I am not taxed on business revenue until the end of the year (or quarterly if it’s a high revenue year) I can either choose to spend more to scale and ultimately make more affiliate commission in the future, or I can take the income as is and allow it to be taxed at the corporate tax rate.

I prefer to reinvest that money, continue to fuel the overall economy, and in the end pay less taxes and make more.

Hope that makes a bit more sense now. Let me know if you have additional questions!

Dalton

Thanks for writing this article,i must say I enjoy every part of the point and all you discuss there about tax,properties and wealthy affiliate

most time I always find it hard to believe that wealthy people most time always win at the court of law when it comes to cases of them not paying tax.but little do I know that they are making use of all that loopholes in the taxation system.

and thanks for giving me a headup on what to write about next on my new website.

Hi ajibola40. I want to clarify that I am not talking about the shady wealthy folks that are evading taxes. That is terrible and I do not support that ideal in any way. You should pay your fair share and support our economy and programs as seen fit by the voters.

Most who legally use loopholes don’t end up in court in the first place. If you are ending up there you are doing something terribly wrong. Usually this is because of unreported income which should never be something you do.

Always claim all of your income. Only also claim actual and reasonable expenses meant for running your business.

Glad you have been able to start your own successful online site. Let me know if you have any questions or need help getting it off the ground!

-Dalton

Thanks for writing out this lovely article and I must say its a must for everyone to read and digest.rich dad poor dad gave a good answer to this question; employees are taxed before they see their money while corporations and business are taxed after they have earned and utilized the revenue to create more profit.beconing an affiliate marketer helps to reduce tax payable. Am proud to be a affiliate marketer with wealthy affiliate. Do not hesitate to join the online money making platform. Thanks for the insight

Becoming an affiliate marketer and starting my own business may have been one of the best things I’ve ever done for my effective tax rate. It’s something that many avoid talking about but there are strategies out there and we can help each other if we just communicated. That’s my goal here, to communicate with you folks who have also pursued affiliate marketing as either a side hustle or full time career.

Congrats on joining Wealthy Affiliate. You’ll find it really is the best platform for commission and education.

-Dalton